Deeper production cuts at leading producer Saudi Arabia, lower output at sanctions-hit Iran, and outages in Libya and Venezuela sent OPEC’s crude oil production in July falling to its lowest level since 2011, the monthly Reuters survey found.

In July, OPEC’s fourteen members pumped a combined 29.42 million bpd, a decline of 280,000 bpd compared to June, according to the Reuters survey that tracks supply to the market from shipping data and sources at OPEC, oil companies, and consulting firms.

While Saudi Arabia continued to cut even deeper than it had done earlier this year in its efforts to ‘do whatever it takes’ to reduce oversupply and bolster oil prices, the three OPEC members exempt from the OPEC+ pact—Iran, Venezuela, and Libya—all saw lower production in July compared to June, the Reuters survey found.

The Saudis pumped 9.65 million bpd in July, after OPEC and its allies extended the production cuts into 2020 at the beginning of the month.

That’s a deeper cut compared to the 9.813 million bpd Saudi production in June that OPEC reported in its official figures. In June, the Saudis had lifted production from May by 126,000 bpd, but they were still producing less than their 10.311-million-bpd quota under the pact.

The Reuters survey for July suggests that the Saudis are trying hard to tighten the market by deepening the cuts.

Elsewhere in the group, the three members exempted from the pact—Iran, Venezuela, and Libya—involuntarily reduced their respective production in July. Iran’s output further dropped due to the U.S. sanctions, Libya briefly shut down its largest oil field Sharara, while another blackout in Venezuela impacted oil production which has been steadily declining amid the economic and political crisis.

OPEC will release its official crude oil production data for July in the Monthly Oil Market Report (MOMR) on Tuesday, August 13.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

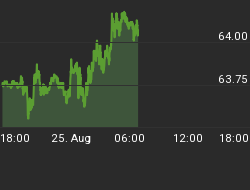

- Oil Trapped In Narrow Price Band

- A Surprising Innovation In Energy’s Hottest Market

- Oil Prices Soar On Huge Inventory Draw